SIP : Systematic Investment Plan

A Systematic Investment Plan (SIP) is a vehicle offered by mutual funds to help investors save regularly. Its just like a recurring deposits with post office or bank where you put small amount every month, except the amount is invested in mutual funds.

Benefit 1

Become A Disciplined Investor

Being disciplined - It’s the key to investing success. With the Systematic Investment Plan you commit an amount of your choice (minimum of Rs. 1000 and in multiples of Rs. 100 thereof*) to be invested every month in one of mutual fund schemes.

Think of each SIP payment as laying a brick. One by one, you’ll see them transform into a building. You’ll see your investments accrue month after month. It’s the perfect solution for irregular investors.

Benefit 2

Reach Your Financial Goal

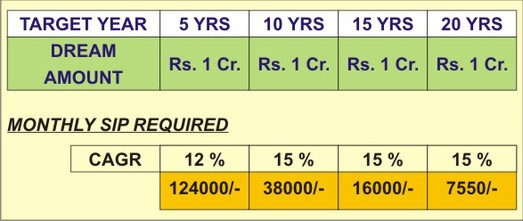

Mutual Fund SIP is a perfect tool for people who have a specific, future financial requirement. By investing an amount of your choice every month, you can plan for and meet financial goals, like funds for a child’s education, a marriage in the family or a comfortable post retirement life. The table below illustrates how a little every month can go a long way.

Benefit 1

Become A Disciplined Investor

Being disciplined - It’s the key to investing success. With the Systematic Investment Plan you commit an amount of your choice (minimum of Rs. 1000 and in multiples of Rs. 100 thereof*) to be invested every month in one of mutual fund schemes.

Think of each SIP payment as laying a brick. One by one, you’ll see them transform into a building. You’ll see your investments accrue month after month. It’s the perfect solution for irregular investors.

Benefit 2

Reach Your Financial Goal

Mutual Fund SIP is a perfect tool for people who have a specific, future financial requirement. By investing an amount of your choice every month, you can plan for and meet financial goals, like funds for a child’s education, a marriage in the family or a comfortable post retirement life. The table below illustrates how a little every month can go a long way.

Disclaimer : The illustration above is merely indicative in nature and should not be construed as investment advice. It does not in any manner imply or suggest performance of any Mutual Fund Scheme(s). Please read Risk Factors.

Benefit 3

Take Advantage of Rupee Cost Averaging

Most investors want to buy stocks when the prices are low and sell them when prices are high. But timing the market is time consuming and risky. A more successful investment strategy is to adopt the method called Rupee Cost Averaging.

Benefit 3

Take Advantage of Rupee Cost Averaging

Most investors want to buy stocks when the prices are low and sell them when prices are high. But timing the market is time consuming and risky. A more successful investment strategy is to adopt the method called Rupee Cost Averaging.

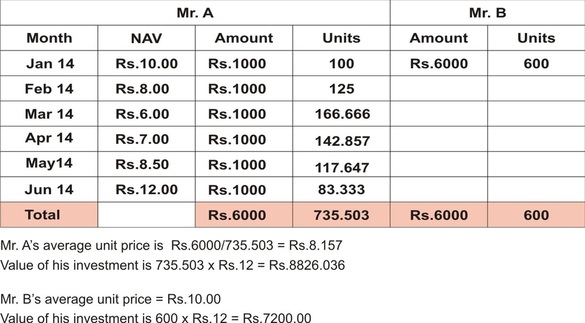

Disclaimer: The illustration above is merely indicative in nature and should not be construed as investment advice. It does not in any manner imply or suggest performance of any Mutual Fund Scheme(s). Rupee Cost Averaging neither ensures you profits nor protects you from making a loss in declining markets. Please read Risk Factors.

As seen in the table, by investing through SIP, you end up buying more units when the price is low and fewer units when the price is high. However, over a period of time these market fluctuations are generally averaged. And the average cost of your investment is often reduced.

At the end of the 6 months, Mr. A has more units than Mr. B, even though they invested the same amount. That’s because the average cost of Mr. A units is much lower than that of Mr. B. Mr. B made only one investment and that too when the per-unit price was high.

As seen in the table, by investing through SIP, you end up buying more units when the price is low and fewer units when the price is high. However, over a period of time these market fluctuations are generally averaged. And the average cost of your investment is often reduced.

At the end of the 6 months, Mr. A has more units than Mr. B, even though they invested the same amount. That’s because the average cost of Mr. A units is much lower than that of Mr. B. Mr. B made only one investment and that too when the per-unit price was high.