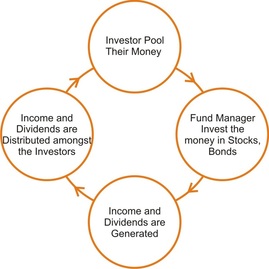

What is Mutual Fund ?These days you are hearing more and more about mutual funds as a means of investment. If you are like most people, you probably have most of your money in a bank savings account and your biggest investment may be your home. Apart from that, investing is probably something you simply do not have the time or knowledge to get involved in. You are not the only one. This is why investing through mutual funds has become such a popular way of investing.

Quite simply, a mutual fund is a mediator that brings together a group of people and invests their money in stocks, bonds and other securities. Each investor owns shares, which represent a portion of the holdings of the fund. Thus, a mutual fund is one of the most viable investment options for the common man as it offers an opportunity to invest in a diversified, professionally managed basket of securities at a relatively low cost. |

Professional Management. Each fund's investments are chosen and monitored by qualified professionals who use this money to create a portfolio. That portfolio could consist of stocks, bonds, money market instruments or a combination of those.

Fund Ownership. As an investor, you own shares of the mutual fund, not the individual securities. Mutual funds permit you to invest small amounts of money, however much you would like, but even so, you can benefit from being involved in a large pool of cash invested by other people. All shareholders share in the fund' s gains and losses on an equal basis, proportionately to the amount they've invested.

Spreading risk: A mutual fund usually spreads the money in companies across a wide spectrum of industries. This not only diversifies the risk, but also helps take advantage of the position it holds.

Transparency and interactivity: Mutual funds clearly present their investment strategy to their investors and regularly provide them with information on the value of their investments. Also, a complete portfolio disclosure of the investments made by various schemes along with the proportion invested in each asset type is provided.

Fund Ownership. As an investor, you own shares of the mutual fund, not the individual securities. Mutual funds permit you to invest small amounts of money, however much you would like, but even so, you can benefit from being involved in a large pool of cash invested by other people. All shareholders share in the fund' s gains and losses on an equal basis, proportionately to the amount they've invested.

Spreading risk: A mutual fund usually spreads the money in companies across a wide spectrum of industries. This not only diversifies the risk, but also helps take advantage of the position it holds.

Transparency and interactivity: Mutual funds clearly present their investment strategy to their investors and regularly provide them with information on the value of their investments. Also, a complete portfolio disclosure of the investments made by various schemes along with the proportion invested in each asset type is provided.

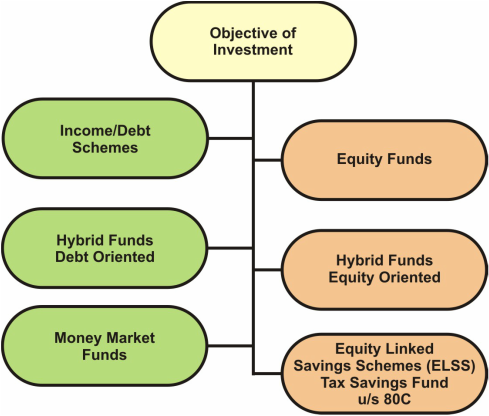

What are different types of Mutual Funds ?

|

Each mutual fund scheme has its own objective that determines its assets allocation and investment strategy.

These are classified according to their maturity period, or investment objective. One can also classify mutual funds as 'open ended funds' - where investors may invest or redeem at any point in time and 'close ended funds' - where investors can invest only during the initial launch period known as the NFO (New Fund Offer) period. Mutual funds classified according to their investment objective range from Equity Funds (with substantial risk), to Money Market Funds (which are very safe). |